Table of Content

These protections often make the insurance process more difficult, although nothing that many regular home insurers or high net worth insurers won’t be able to handle. You may be turned away by some, but companies that insure grade 2 buildings will be able to provide reinstatement insurance, at least in part. Thatch is essentially straw or reeds bundled together to form a thick waterproof layer over your house.

Aston Lark’s Private Medical Insurance can cover the cost of your private hospital treatments for curable medical conditions. Lightfoot is an innovative driver reward platform that utilises in-cab technology to provide real-time feedback to drivers and rewards positive driver behaviours. Here at Aston Lark, we offer a range of tailored reviews, helping you understand your ability to withstand and recover from major, unplanned disruption. Our cloud-based risk management tool has a range of valuable resources to help you fulfil your regulatory compliance and improve your operational resilience.

Specialist thatched property insurance

It’s always best to research and shop around to compare home insurance quotes and find a policy that suits your needs and is affordable. If you own a thatched property and are looking for a great deal on your buildings and contents insurance with a specialist in thatched properties, then look no further. Whether it’s for your home, holiday hideaway or buy-to-let nest egg, we provide specialist thatched property insurance that won’t let you down. A thatched house might be your dream home, but for thatched housing cheap building insurance can be hard to come by. Read our guide to find out more about thatched home insurance and how to insure your home when your property is made with non-standard materials.

For companies that rely on technology to conduct business, it’s more important than ever to take steps that can prevent cyber criminals getting hold of information. Aston Lark arranges insurance for a significant proportion of the car transportation industry, helping them find the right insurance solutions for their business. Aston Lark has a wealth of experience working with a variety of different businesses in this sector including hardware and software, e-commerce, internet and telecommunications companies, to name a few.

Is House Insurance More Expensive With A Thatched Roof?

Our fleet auditing service provides you with a clear and detailed report which identifies the strengths and weaknesses in your overall Occupational Road Risk programme. Our risk control survey menu offers three different and innovative ways to carry out a survey, no matter when and where. We have specialist knowledge of the metal recycling and vehicle dismantling industries which stretches to over 20 years. Commercial Motor Fleet insurance is vital for many organisations, as their fleet of vehicles is a significant investment and is often a key part to ensuring their operations are efficient and successful. We arrange cover for motor traders, haulage operators, self-drive hire companies, vehicle recovery operators and classic car restorers, as well as a whole fleet of others.

As soon as we have spoken to you we discuss and negotiate with them on your behalf to get the best offer of insurance. At the same time, we explain the endorsements and your responsibilities to ensure the Thatched Home Insurance policy is valid if you need to make a claim. Today, quite a lot has changed and thatched homes are now a far wealthier symbol, evoking images of the idyllic countryside and 18th-century villages. The building of thatched houses is said to be on the rise in the UK despite the difficulty in sourcing cheap materials for the thatched roofs and the complications in finding appropriate insurance.

Aviation Insurance

Our competitive buildings and contents insurance policies are available separately or together. Thatched housing was once a symbol of poor communities in the British countryside, as the materials used in creating the signature roofs were so readily available. The result gave buildings a lighter roof that could be held up with lesstimberthan other types of house, and thus were built at a cheaper cost.

Thatching is the oldest type of roofing in the UK and has been used for centuries. Often seen in the countryside, it’s no longer a very common way to roof your house. Although aesthetically very pleasing it’s quite an expensive way to roof your home. It requires special material, expert knowledge and skills to maintain and repair. Insurers see this as a high risk type of property to insure due to it being qualified as a non-standard type of home and what they observe as an increased fire hazard. This, in turn, can make it a more complicated type of property to insure and more expensive too.

Charity Insurance

Alongside the privilege and prestige of owning a listed property, there are some serious responsibilities and obligations. With the rise of the ‘staycation’ and the growing presence of online rental companies, renting your property has never been easier. However, making sure you have the right insurance in place has become increasingly complicated. Whether your holiday home is in the UK or overseas, a sprawling villa or a country gite, it still deserves the same quality of policy and service.

Non-standard policies consider the unique requirements of thatched homes. Providing you with a fairer policy for thatched house insurance than you might get with a regular home insurance policy. We are a highly experienced thatch home insurance broker who understands the specific risks that come with insuring thatched homes. We have a panel of leading insurers and our team know where to find the finest quality of cover for the best value of money. Firstly, we offer specialist Thatched Home Insurance policies from the best UK underwriters. Above all, these are trusted UK based insurers who know all about the particular needs of a thatched property.

If it’s not already included, you can usually add extra elements of cover on to your policy, such as legal expenses cover and accidental damage. This could lead to cheaper premiums and better quality specialist repairs that meet the needs of your property. Owning a piece of history comes with the responsibility of looking after it effectively. Thatch on a roof can last anywhere from twenty to sixty years before needing at least partially replacing. This depends mostly on the quality of the materials used, as well as the quality of the thatchers that installed the roof.

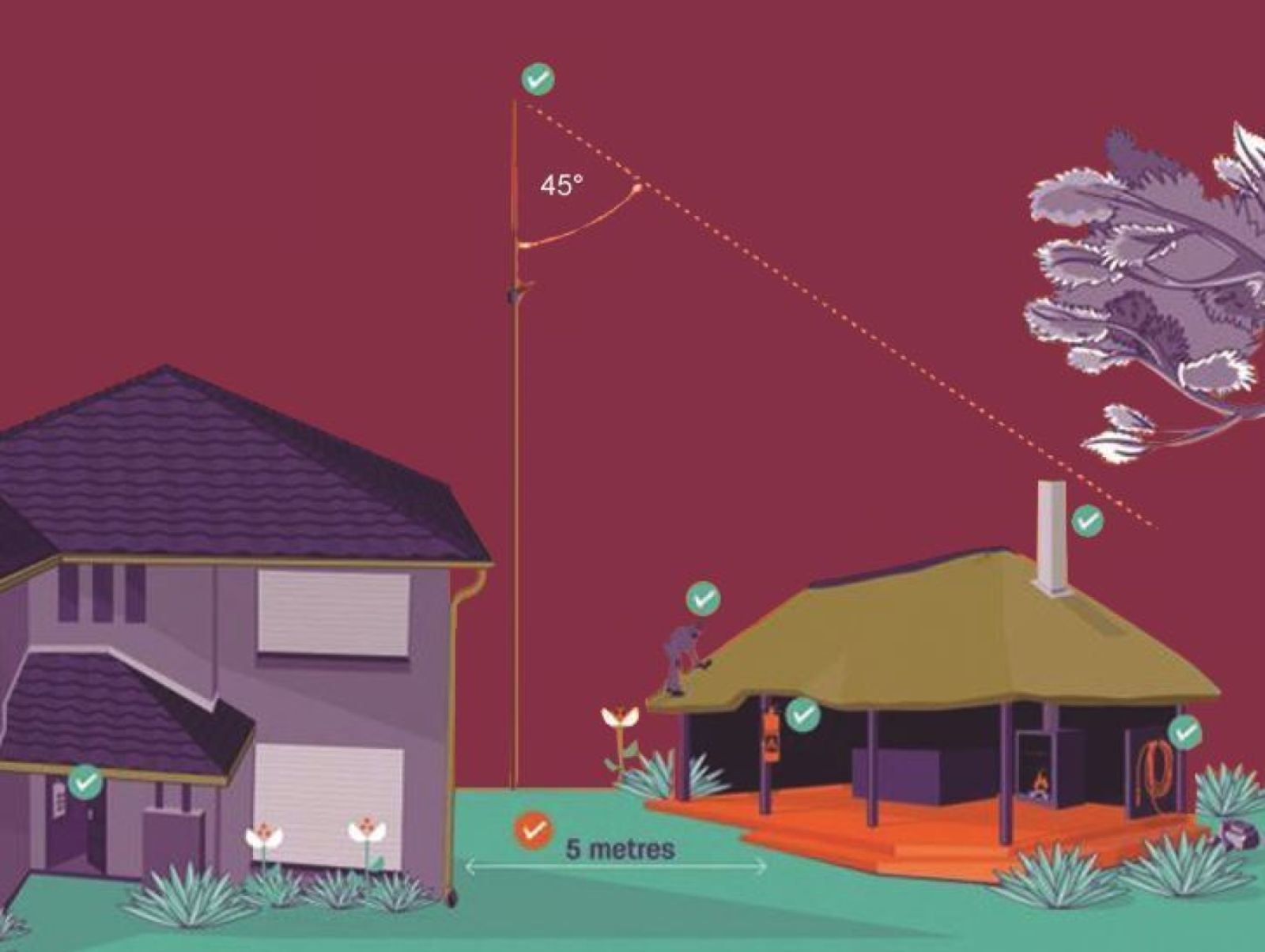

However, we will provide appropriate information to allow you to make an informed decision about how you wish to proceed. It’s worth checking the policy details if your roof falls outside of these categories. Yes, as you can imagine some of the nicest old pubs are thatched and they are not the easiest to insure. Use a fire-retardant spray on your roof or have a fire-resistant barrier such as an aluminium foil barrier installed under the thatch.

They are made from natural, sustainable materials that are often locally sourced, and also provide excellent insulation, allowing homes to retain heat in winter and stay cool in summer. Skilled thatchers maintain some of the UK’s oldest cottages and homes, and also provide new roofs for many property developers and homeowners who prefer this old roofing style. Thatched roofs are durable, sustainable and add real character to the aesthetics of a home. A thatched roof is more expensive to build than standard concrete tiles, but when laid correctly and properly maintained, thatched roofs can last up to 60 years. For your peace of mind, it’s vital to make sure that you’ve got the right insurance to protect your home. At the present time there are few brokers in the UK that can match our knowledge and understanding of what thatched property owners need.

No comments:

Post a Comment